Feb 10 2016

Gig Harbor home prices catch up to “boom” years

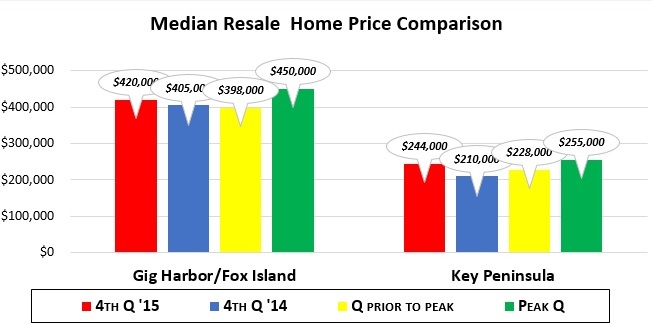

Gig Harbor home prices catch up to “boom” years. Gig Harbor resale home prices have climbed back to 2006’s boom year $420,000…and just 6.6% off that year’s summer bubble.

So that is the resale market for Gig Harbor home prices. New construction is another matter. Off 35% from its 2007 high, the forces at work may not allow local prices to catch up for several reasons. National and regional builders, rather than local small builders of 10 years ago, are building smaller on smaller lots (thank you Growth Management), with less detailing for the main part. Many of current lots, other than Harbor Hill, were picked up at rock bottom prices from banks who acquired them in the recession. Lot prices will increase as new inventory comes online…but the pipeline is slim and then in-fill lots will be the future. I believe Gig Harbor North will be built-out by 2017, considerably ahead of original plans.

Highlights for Gig Harbor home prices

- It’s a seller’s market up to $750,000, with just a 3.8 month supply, even in the $500-750,000 category. Last year that range was working through a 13.4 month supply

- It is averaging just 3 months market time in the $500-750,000 range, less below $500,000

- 39% of the 228 listings, and 1 of 4 sales last month were new homes

- Inventory is down 30% and contracts written are running about 20% higher than a year ago

- Highlights for Key Peninsula home sales

- Resale home prices are running $244,000 for last 3 quarters—same as 2007-2008 “best years”

- Distressed sales still hover at 15%, but down from 35% 2 years ago

- New construction has not returned in any measurable way

Here are my observations…and predictions for Gig Harbor home prices

Interest rates finally started their climb which will bring buyers to the buying table sooner than later, even though these are historically some of the lowest. I expect rates to remain under 5% for the year.

Lending requirements are beginning to loosen a bit which will particularly help first-time buyers.

Wages are still a drag on the economy. That will either slow the creep for Gig Harbor home prices or continue to magnify the difference of who can buy and who can’t.

Inventory will remain low for two reasons. Sellers are waiting to cash in more of their equity with higher Gig Harbor home prices. But more likely those same sellers can’t find a home to move into. There is a very large “supply” of sellers with “pent-up” selling desires.

Waterfront home sales are “behind” 150 or more that should have sold historically during the period of the recession. The 120+ sales in each of the last three years hasn’t caught up to the recession years with only 4-5 dozen home sales.

Year of the new house, with most buyers settling for less privacy, yard and trees. But new.