Gig Harbor home sales—something for everyone

- Local inventory ↓ 17% from 2011 –7.2 mo supply

- King/Sno/Pierce inventory ↓ 42.65% from 2011

- Median price ↓ 1% Y-T-D –rate of decline slides

- Waterfront prices↑ 6% Y-T-D

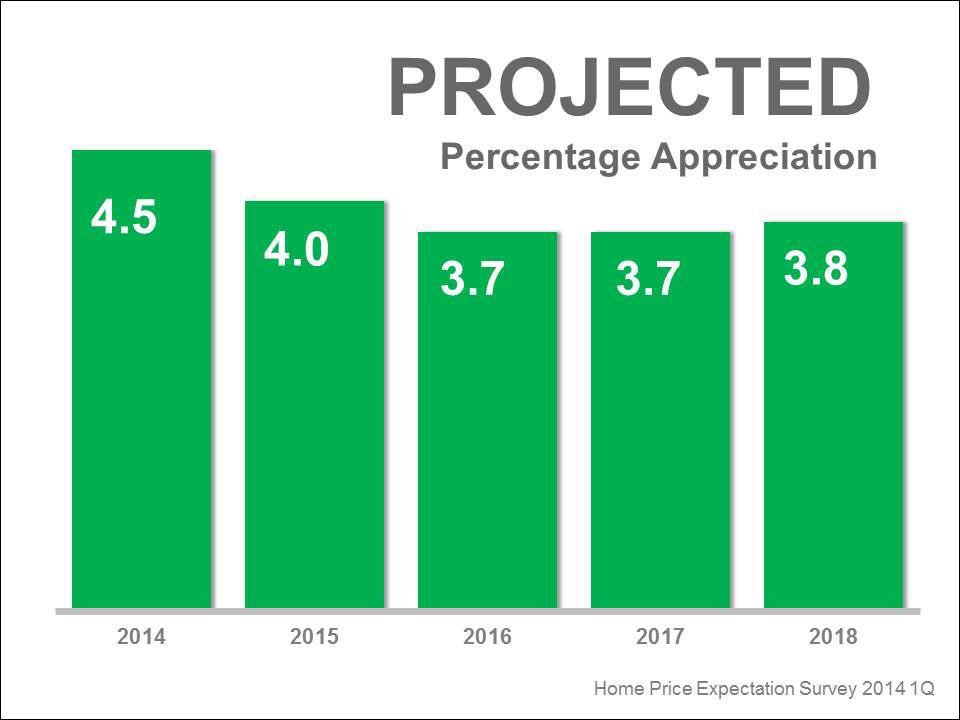

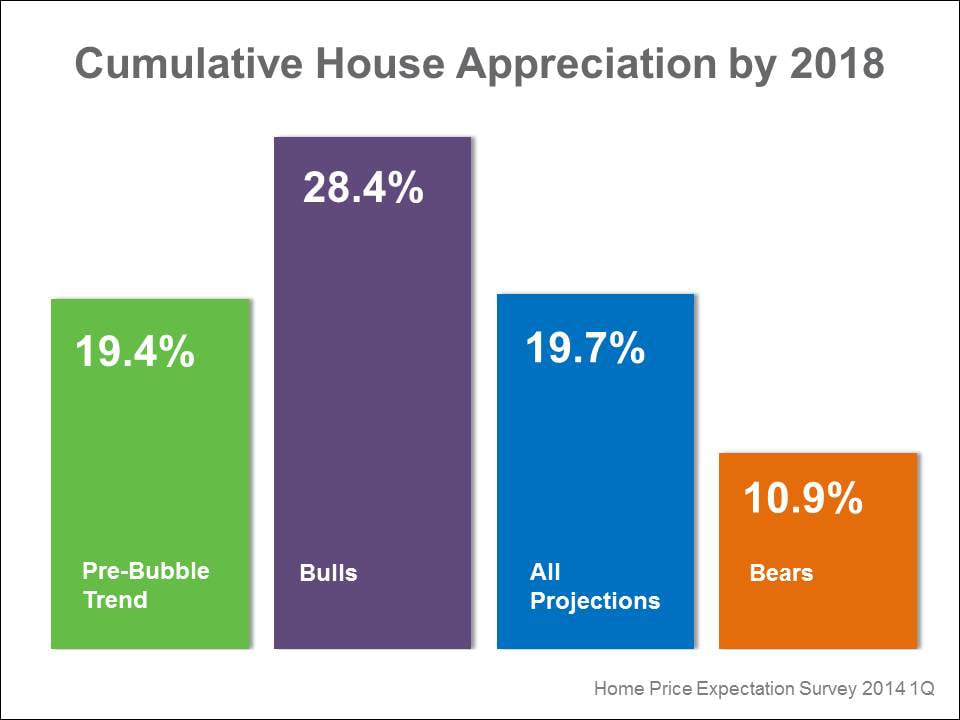

- Nationally, price increase ↑3.5% not to 2016

- Local sellers’ market through $350,000 prices

- Local balanced market through $700,000 prices

- Washington REO inventory less than 2%

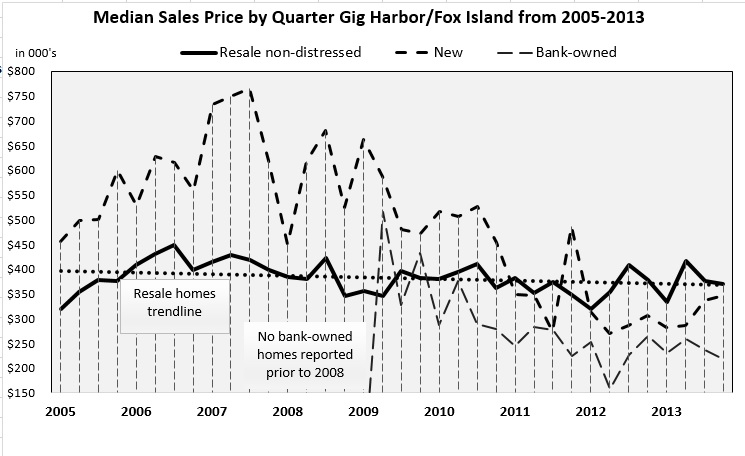

Gig Harbor home sales are trending with overall national figures. Sales–the first part of any housing recovery have come back with vigor. Prices–the second piece of the recovery is lagging. Both Gig Harbor and Key Peninsula have experienced as many positive as negative months this year–again typical nationally.

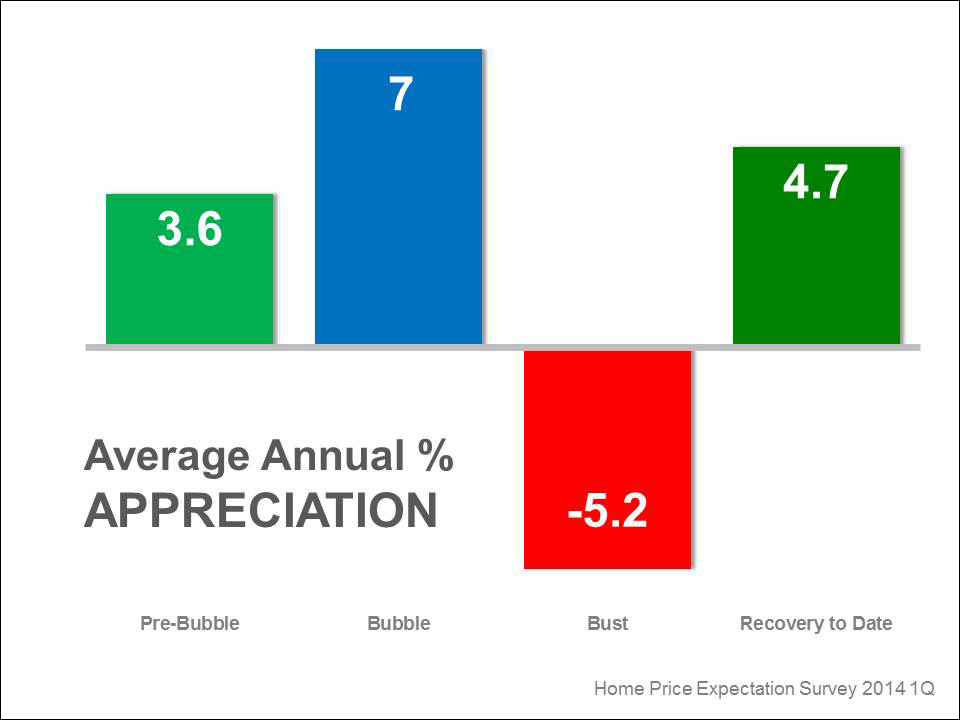

Prices are declining at a shallower rate than in past months. Both peninsulas are currently at second half 2004 prices for Gig Harbor home sales —improved from 2003 prices we experienced most of last year but still down 1% for the first half of the year.

The good news is that distressed Gig Harbor home sales have dropped 10% from the beginning of the year—another national trend. Short sales outnumber REO properties nearly 2-1. And currently distressed homes make up just 10% of the inventory.

Washington is fortunate to have a non-judicial foreclosure process which has cleared the backlog faster than in states where the courts make the determination. This leaves less shadow inventory in the wings as well. In fact Washington has less than a 2% foreclosure rate—one of the lowest in the country. Lenders are working more aggressively with homeowners on modifications and short sales.

An increase in Gig Harbor home prices depends on supply and demand. The supply side is down to seven-month inventory but prices haven’t spiked yet—largely because anticipation of surfacing foreclosed properties. We will know shortly if we need to factor in more than the current 2% into the market pricing equation for Gig Harbor home sales. Inventory in the tri-counties has dropped 42% from last year—the fifth largest drop in the nation.

So this summer is an excellent window for sellers—inventory is low and interest rates have never been lower. Home supply is down nearly 20% from a year ago and over 40% from the peak. It is truly a sellers’ market under $350,000 and a nicely balanced market up to $700,000.

There is a tremendous pent-up demand for sellers who want to move for employment, be closer to family or scale down in size. And there appears to be little reason to wait for price increases because the national prediction is it will take until 2016 for house prices to reclaim the 3.5% increase in value considered the pre-bubble “normal”. Maybe a bit more down this year, up 1.3% in 2013 and 2.6% in 2014, is what the June Home Price Expectation Survey says.

Friday respected magazine The Economist, reported “America’s houses are now among the world’s most undervalued: 19% below fair value, according to our house-price index.” Another good reason to buy.

As I said at the beginning…there is something in Gig Harbor home sales news for everyone.