Sep 01 2014

Gig Harbor waterfront prices up 10%

Gig Harbor waterfront prices up 10%

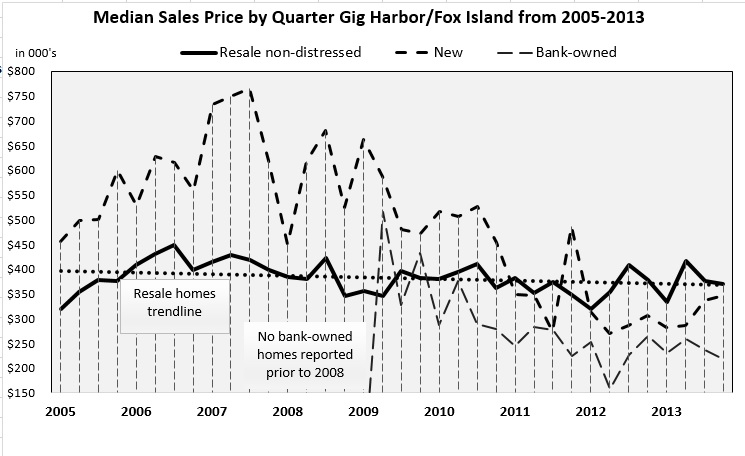

Gig Harbor waterfront prices up 10%, January to mid-May, over the 2013 year. The entire price bump is coming from Gig Harbor and Fox Island—up 14% while Key Peninsula is experiencing a 7% decrease. Here are the highlights…

Sales volume for Gig harbor waterfront

- On track for 100 sales by year-end—fairly typical

- Slower thus far than 2013’s all-time high of 135

- Sweet spot is $500-600,000, 4 closed/2 active listings

- Also $400-500,000, 8 closed/14 listings

- Also $900,000, 4 closed/8 listings

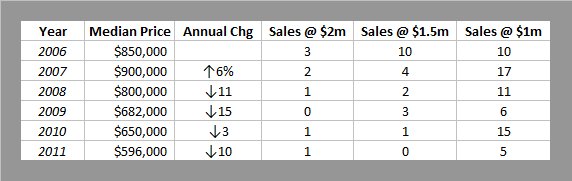

Median sales prices y-t-d for Gig Harbor waterfront

- Prices ↑ 10% on both peninsulas over 2013 year–$550,000

- Prices still ↓ 38% from 2007 peak

- $1m+ represents 30% of listings—but just 11% of sales

- $1m+ average 2 years on market before sale

- Under $1m—average under 6 months on the market

- Gig Harbor/Fox Island ↑ 14% over 2013–$713,000

- Gig Harbor highest sale $2,960,000 after 6 ½ years

- Key Peninsula ↓ 7%–$ 395,000

- Key Peninsula highest sale $600,000 this year

Proposed Gig Harbor waterfront changes muddy the waters

The proposed all-new Shoreline Master Plan for Gig Harbor waterfront, mandated by the State, is proceeding cautiously—with local hearings postponed by the Pierce County Council. The Council has chosen to push back against the State Department of Ecology on issues including buffers and aquaculture, but with the threat the State will impose more onerous regulations on shoreline properties if the Council can’t agree. The current 50 foot “setback” is proposed to change to a 75-150 foot “vegetative buffer.” And structural expansion into the “buffer” would be limited to 25% of the existing footprint, in most cases.

Every Gig Harbor waterfront owner should pay close attention to the current process and seek professional assistance, “sooner than later” if there is any thought of expanding, building or selling in the future.