Apr 01 2013

Existing Gig Harbor home prices take jump

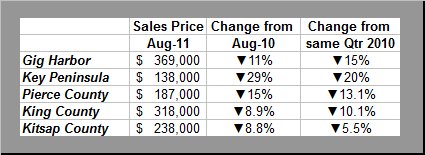

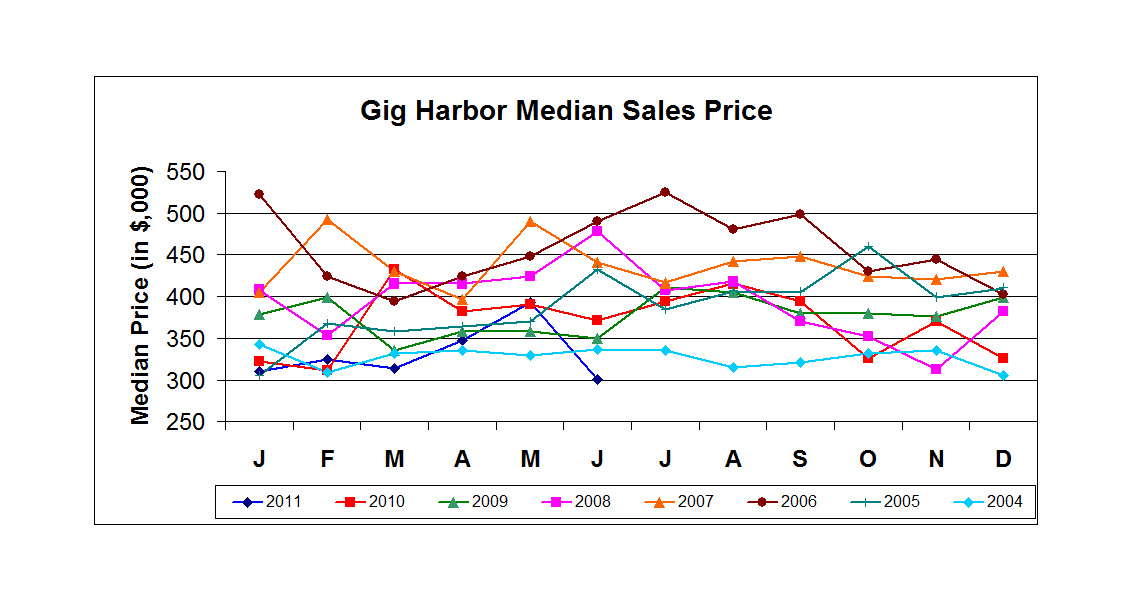

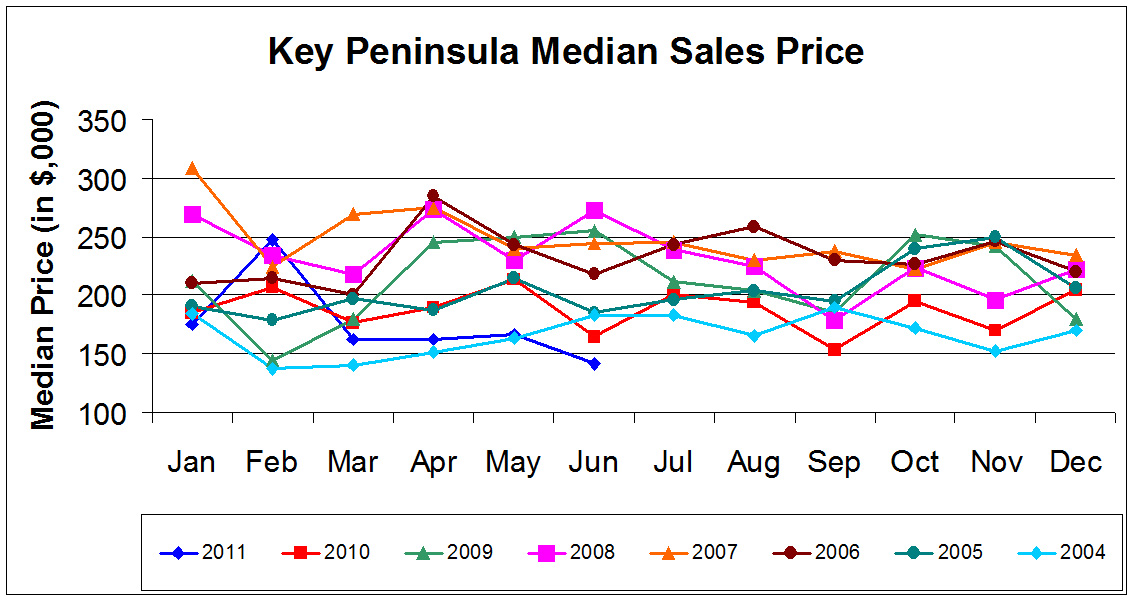

Existing Gig Harbor home prices take jump. My past reports of year-over-year drops for Gig Harbor home prices may be behind us for now. Existing Gig Harbor home prices are up over 11% for the November-January quarter, over a year ago, for Gig Harbor/Key Peninsula combined. And one home sale just closed for $3,600,000—the first sale over $3 million for nearly five years.

Existing Gig Harbor home prices— median

- Gig Harbor ↑ 5.3% quarterly

- Key Peninsula ↑ 3.9% quarterly

- Pierce County ↑8.4% quarterly

- Gig Harbor/Key Peninsula volume ↑ 19% quarterly (12.5% annually)

- Inventory ↓17% from a year ago

New Gig Harbor home prices–median

- Gig Harbor/Key Peninsula ↓ 42% quarterly

- Gig Harbor/Key Peninsula ↓ 22.5% from 2010

- Gig Harbor/Key Peninsula volume ↑ 250% quarterly (40% annually)

An interesting sidebar to our trending Gig Harbor home prices is new construction. Nearly all of Gig Harbor’s current construction is in Gig Harbor North…Quadrant and Rush. New construction accounts currently for less than 10% of all sales, with the median price hovering under $300,000. In 2010 the median price was $470,000 and in 2011 $330,000. This year’s median price computes to a 13% drop in price from 2011…and 39% for the year before.

Gig Harbor’s new construction pricing will be a drag on the combined new and existing median price, at least for a while. For a better perspective of the trending market for Gig Harbor home prices going forward I will separate these two. Sellers have more interest in resale prices while buyers watch both new and existing prices as they make their buying decisions.

Two of the county’s other major new home areas have experienced an increase in sales price, compared to Gig Harbor home prices; at the same time new construction is a larger portion of their overall sales. In Puyallup roughly 25% of sales are new homes with prices up 4.7% quarterly from a year ago. New homes in Bonney Lake account for about 16% of sales and prices have increased 8.8% for the same period.

The price differences can be explained, in part, that during the economic downturn builders in the east side of the county were able to take advantage earlier of bank foreclosed plats, with drastically reduced lot prices. Builders passed lower lot costs on to their consumers. Banks took longer to foreclose on builders/developers in Gig Harbor and the current inventory is now reflecting those lower lot prices and thereby Gig Harbor home prices. Six years ago Gig Harbor had a bevy of small builders building high-quality product on larger lots. Currently most of those builders are gone and only the corporate builders remain, building on smaller Urban Growth Area (UGA) size lots.

This may change slightly as two builders have purchased lots in two uncompleted subdivisions and will likely be building in the $450-550,000 range.