Short sales small percent of Gig Harbor home sales National media hypes short sales and bank-owned properties as a large part of the market, but in Gig Harbor they represent a smaller portion of Gig Harbor home sales than the casual observer might think. Key Peninsula is not as fortunate but still better than many parts of the country.

22.6% of Gig Harbor home sales in the past six months have been bank-owned or short sales and 41% in Key Peninsula.

This compares to figures as high as 80% of all sales in Las Vegas and 50% in Phoenix and Southern California and parts of Florida. North Las Vegas currently has one in 50 homes in some stage of foreclosure, and in parts of Phoenix it is one in 20 homes, and some areas of southern California it is one in 50 homes. In Washington State one in 834 homeowners is in financial trouble with the bank but in Pierce County it is one in 418 owners, making it the highest rate of foreclosure in the state.

Dissecting short sales and bank-owned numbers--7% of Gig Harbor home sales have been short sales and 15.5% bank-owned.

Key Peninsula's stats are a bit gloomier. Short sales represented 6.4% but bank-owned made up 28% of all sales.

Pierce County, in the past six months, turned out 35% of sales as short sales and bank-owned units. So our Key Peninsula fits the county norm.

An interesting side note is the pending sales. Pending sales (transactions not yet closed) indicate 25% more short sales or bank-owned are in the current mix than have closed in all the past 6 months. There are 85 pending in Gig Harbor and 32 in Key Peninsula while sales in those categories only total 64 and 43 respectively. This is not a surprise to Realtors or buyers who have tried to negotiate short sales with lenders. Many of the transactions written will never close due to difficulty of working through one and sometimes two lenders. Many buyers become frustrated with the situation and move on to other good deals in the marketplace.

Bank-owned homes run the price gamut, with 19 under $250,000, 13 between $250-500,000 and 7 over $500,000-in fact running all the way up to $1m and above. This is the place the buyers can be certain the lender wants to sell and a sale can be completed.

Carole Holmaas is an Associate Broker with Windermere Real Estate, licensed since 1967. She may be reached at 549.6611 or Carole@ISellGigHarbor.com. Her blog may be followed at http://blog.ISellGigHarbor.com

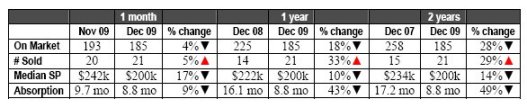

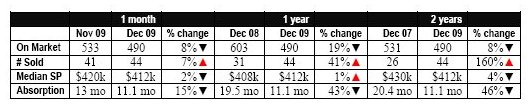

Realtors have been pleased with the relatively strong market for December and the momentum appears to be continuing with sales activity in January. Much of those sales are being driven by the first-time home buyer tax credits and low interest rates. Interest rates are starting to tick upward and are expected to peak around 6.5% during 2010.

Inventory continues to drop-down 33% from last year at this time. This is helping stabilize prices as the home supply dwindles. Key Peninsula is currently experiencing just an 8.8 month supply of homes on the market. For the homebuyer, that means if no new homes were listed, it would take about nine months to sell the current inventory. I would expect the supply to drop even more as January sales activity continues to hum.

Carole Holmaas is an Associate Broker at Windermere Real Estate/Gig Harbor, licensed since 1967. She may be reached at 253.549.66 or Carole@ISellGigHarbor.com. Her blog may be followed at http://blog.ISellGigHarbor.com

Realtors have been pleased with the relatively strong market for December and the momentum appears to be continuing with sales activity in January. Much of those sales are being driven by the first-time home buyer tax credits and low interest rates. Interest rates are starting to tick upward and are expected to peak around 6.5% during 2010.

Inventory continues to drop-down 33% from last year at this time. This is helping stabilize prices as the home supply dwindles. Key Peninsula is currently experiencing just an 8.8 month supply of homes on the market. For the homebuyer, that means if no new homes were listed, it would take about nine months to sell the current inventory. I would expect the supply to drop even more as January sales activity continues to hum.

Carole Holmaas is an Associate Broker at Windermere Real Estate/Gig Harbor, licensed since 1967. She may be reached at 253.549.66 or Carole@ISellGigHarbor.com. Her blog may be followed at http://blog.ISellGigHarbor.com

Carole Holmaas is an Associate Broker at Windermere Real Estate/Gig Harbor, licensed since 1967. She may be reached at 253.549.6611 or Carole@ISellGigHarbor.com. Her blog may be followed at http://blog.ISellGigHarbor.com

Carole Holmaas is an Associate Broker at Windermere Real Estate/Gig Harbor, licensed since 1967. She may be reached at 253.549.6611 or Carole@ISellGigHarbor.com. Her blog may be followed at http://blog.ISellGigHarbor.com

Key Peninsula's stats are a bit gloomier. Short sales represented 6.4% but bank-owned made up 28% of all sales.

Pierce County, in the past six months, turned out 35% of sales as short sales and bank-owned units. So our Key Peninsula fits the county norm.

Key Peninsula's stats are a bit gloomier. Short sales represented 6.4% but bank-owned made up 28% of all sales.

Pierce County, in the past six months, turned out 35% of sales as short sales and bank-owned units. So our Key Peninsula fits the county norm.

An interesting side note is the pending sales. Pending sales (transactions not yet closed) indicate 25% more short sales or bank-owned are in the current mix than have closed in all the past 6 months. There are 85 pending in Gig Harbor and 32 in Key Peninsula while sales in those categories only total 64 and 43 respectively. This is not a surprise to Realtors or buyers who have tried to negotiate short sales with lenders. Many of the transactions written will never close due to difficulty of working through one and sometimes two lenders. Many buyers become frustrated with the situation and move on to other good deals in the marketplace.

Bank-owned homes run the price gamut, with 19 under $250,000, 13 between $250-500,000 and 7 over $500,000-in fact running all the way up to $1m and above. This is the place the buyers can be certain the lender wants to sell and a sale can be completed.

Carole Holmaas is an Associate Broker with Windermere Real Estate, licensed since 1967. She may be reached at 549.6611 or Carole@ISellGigHarbor.com. Her blog may be followed at http://blog.ISellGigHarbor.com

An interesting side note is the pending sales. Pending sales (transactions not yet closed) indicate 25% more short sales or bank-owned are in the current mix than have closed in all the past 6 months. There are 85 pending in Gig Harbor and 32 in Key Peninsula while sales in those categories only total 64 and 43 respectively. This is not a surprise to Realtors or buyers who have tried to negotiate short sales with lenders. Many of the transactions written will never close due to difficulty of working through one and sometimes two lenders. Many buyers become frustrated with the situation and move on to other good deals in the marketplace.

Bank-owned homes run the price gamut, with 19 under $250,000, 13 between $250-500,000 and 7 over $500,000-in fact running all the way up to $1m and above. This is the place the buyers can be certain the lender wants to sell and a sale can be completed.

Carole Holmaas is an Associate Broker with Windermere Real Estate, licensed since 1967. She may be reached at 549.6611 or Carole@ISellGigHarbor.com. Her blog may be followed at http://blog.ISellGigHarbor.com