Dec 25 2010

Gig Harbor waterfront sales on par with 2007

Gig Harbor waterfront sales on par with 2007

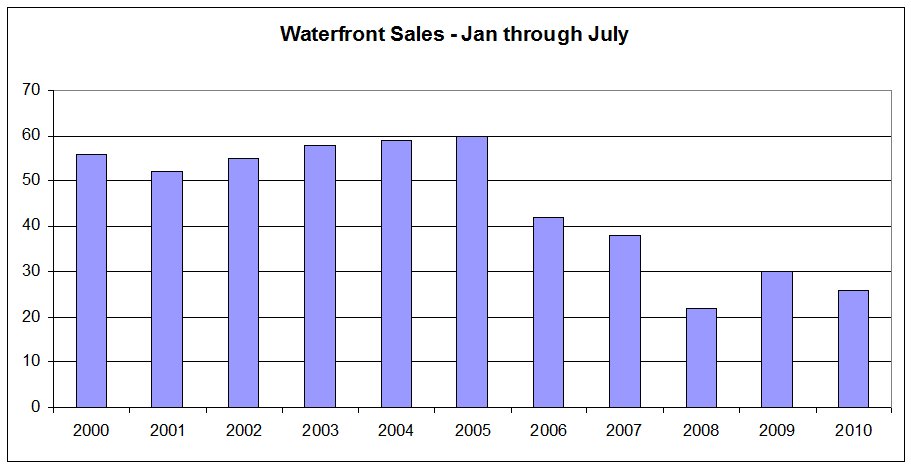

Simply for Gig Harbor waterfront sales to be at the same level as 2007 shows the increasing strength of Gig Harbor’s real estate market. The first half of the year was down from the 2009 volume. But the Gig Harbor waterfront homes market picked up steam in July and again in September.

This year will likely close with as many, or nearly as many sales as 2007—64. While the peak of the real estate market was 2006 and early 2007, neither year produced the highest number of waterfront sales. Sellers weren’t selling when the market was “that strong.”

The average yearly number of sales for Gig Harbor waterfront homes is 101–from 1998 through 2005. This number was consistent even during the recessionary early years of this decade. The low point was 2008 with just 40 sales followed by the second worse year 2009 with 51 sales.

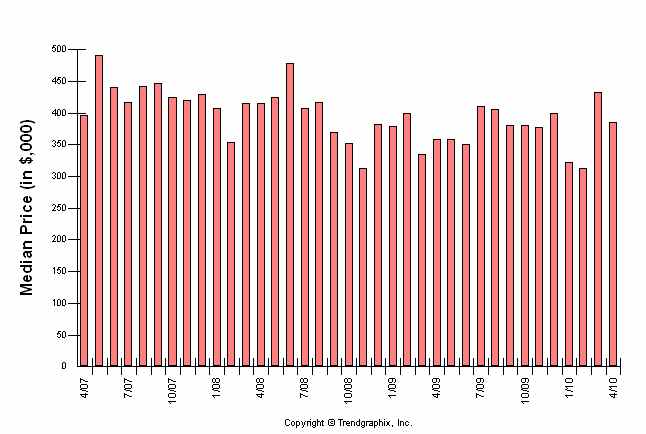

Nearly half of the current inventory of Gig Harbor waterfront homes is listed over $1m. This year’s median price—half the sales above and half below—may not climb much above the $682,500 figure from last year. A few months ago it looked like this figure might increase—but not now. But simply to not decrease is positive.

Normally Gig Harbor contributes two-thirds of the sales and Key Peninsula one-third. This year just 12% have come from Key Peninsula. I have to presume this is because buyers have had a number of less expensive options to chose from in Gig Harbor…and have not found it necessary to travel the extra miles to quality waterfront.

Sales over $1m have strengthened this year with twice as many as last year. 11 homes sold up to $1,250,000 and six above that—but only one over $2m. Two or three is the most we ever have over $2m—but the range that has been hit the hardest is the $1.5-2m…there were 10 in 2006…and one this year.

The median sales price for Gig Harbor waterfront homes as a percentage to assessed value is currently running 91%. In other words, homes are closing for 91% of the county assessor’s valuation. Homes over $1m actually sold for 104% of assessed value…a figure that changes dramatically under $1m.

For whatever it is worth, here are the ups and downs in median prices for Gig Harbor waterfront homes over the past six years:

| Median SP | Chg from prior year | |

| 2004 |

$488k |

|

| 2005 |

$680k |

40%▲ |

| 2006 |

$850k |

25% ▲ |

| 2007 |

$900k |

6% ▲ |

| 2008 |

$800k |

11% ▼ |

| 2009 |

$683k |

15% ▼ |

| 2010 | Close to 2009 | Will know next week |

Carole Holmaas is a Managing Broker at Windermere Real Estate, licensed since 1968. she specializes in waterfront and view properties. She may be reached at 253.549.6611 or Carole@ISellGigHarbor.com.