Feb 13 2012

Brakes applied to Gig Harbor home price slide

Brakes applied to Gig Harbor home price slide.

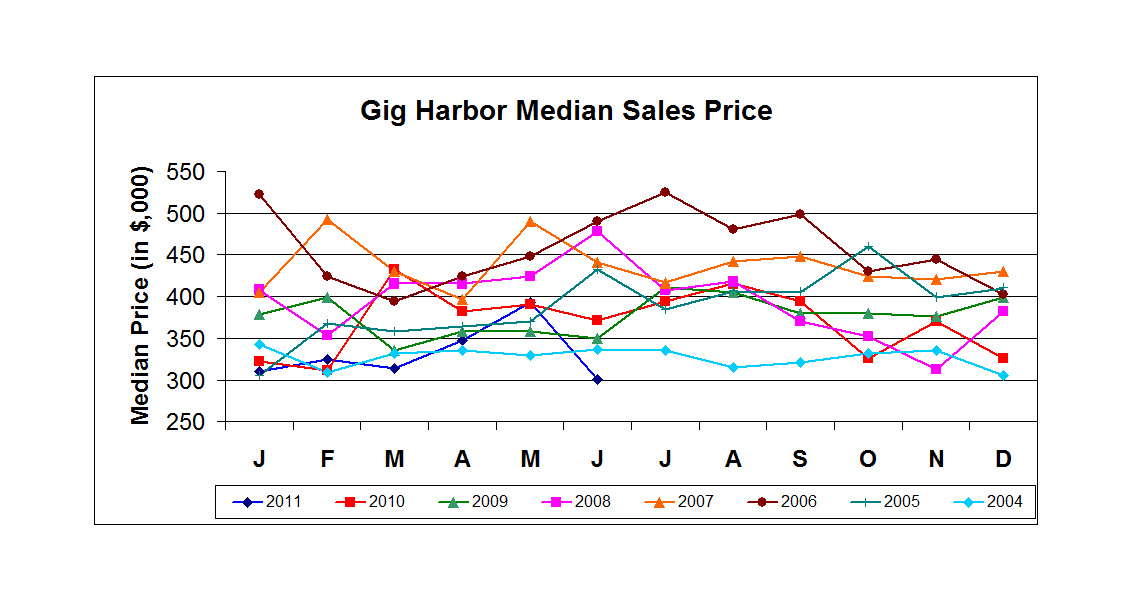

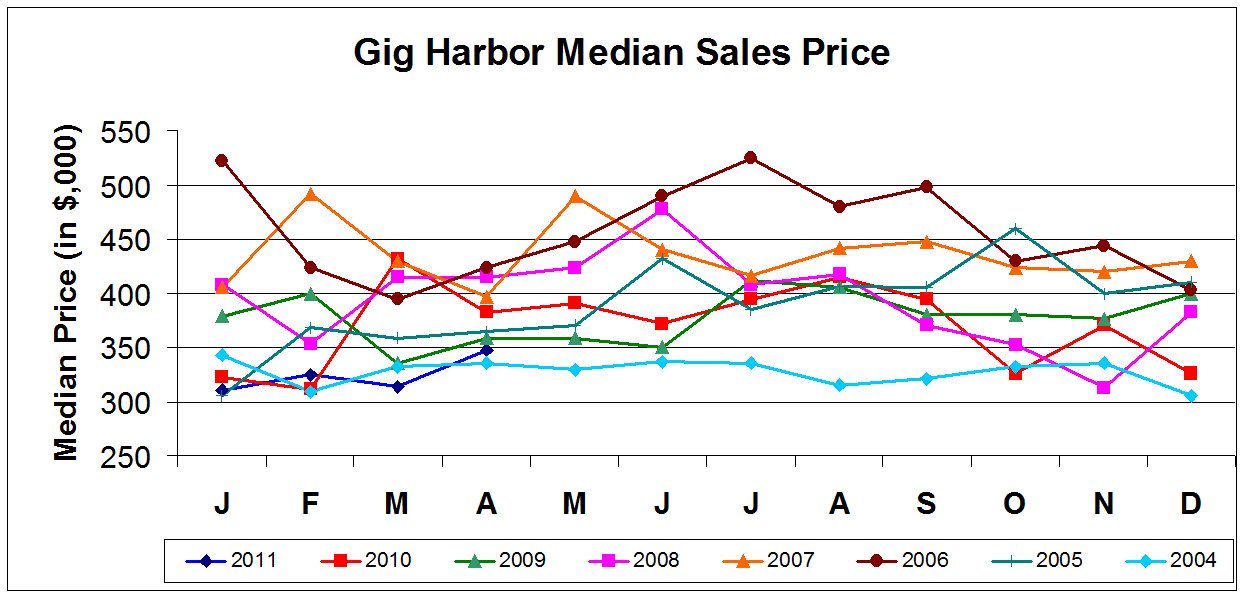

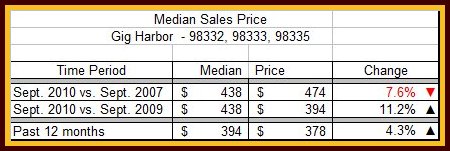

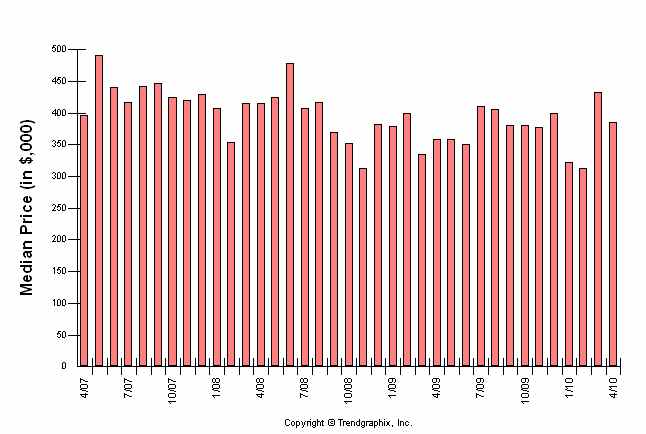

The slide of the last five and a half years for Gig Harbor home prices has slowed in the last couple months while dropping 10% for the year. Sales for 2011 shows Gig Harbor home prices(including Fox Island) neither bank-owned or short sales in the 4th quarter declined only 3% rather than the 17% drop experienced in third quarter.

- Inventory is currently down 20% from a year ago and 40% from 2008

- Median sales price in 4th quarter stood at $352.000 for non-distressed properties and $225,000 for bank-owned or REO (real estate owned). The REO figure reflects a 19% drop from 4th quarter 2010 Gig Harbor home prices

- REO sale prices dropped about 15% for the year and non-distressed were down 10%

- All Gig Harbor home prices are trending back to 4th quarter 2004 but when removing distressed sales from the equation prices are similar to 1st quarter 2005 prices

- Homes are staying on the market fewer days—from 7-8 months in early 2011 to 4 months currently

- A few more homes and condos sold in 2011 than 2010

- January Gig Harbor home prices are trending up as well—higher than 6 of the past 12 months

Local 2011 quarterly statistics for Gig Harbor home prices highlight the difference between heavily discounted bank-owned houses and the “rest of the market”. REO sales represented 28% of all home sales in the first quarter but only 18-19% the last half of the year. This is expected to increase again as the lenders begin to ratchet up foreclosures after last week’s settlement with the five largest lenders, pertaining to sloppy methodology including robo-signing of documents. REO sales are still expected to maintain a solid presence in the housing market the balance of this year. Nation-wide foreclosures decreased 34% last year over 2010…but are expected to increase 25% in 2012.

Short sales are not separated out in the table above because they actually do not affect the overall median price much. They are spread throughout all prices and tend to settle closer to the non-distressed market price. In fact the fourth quarter saw short sales close higher than non-distressed sales and much higher than the year before. 2011 is the year lenders have become receptive to the process, along with the help of negotiators who specialize in short sales.

The monthly national data shows some stabilization or increases in select markets one month while the next month produces data showing nearly all metropolitan areas are still down. Bright spots in the Puget Sound are the hiring Boeing and its contractors are doing plus overall improvement in employment.

Carole Holmaas is a Managing Broker at Windermere Real Estate/Gig Harbor, licensed since 1967. She specializes in waterfront and view properties and may be reached at 253.549.6611 or Carole@ISellGigHarbor.com