May

18

2011

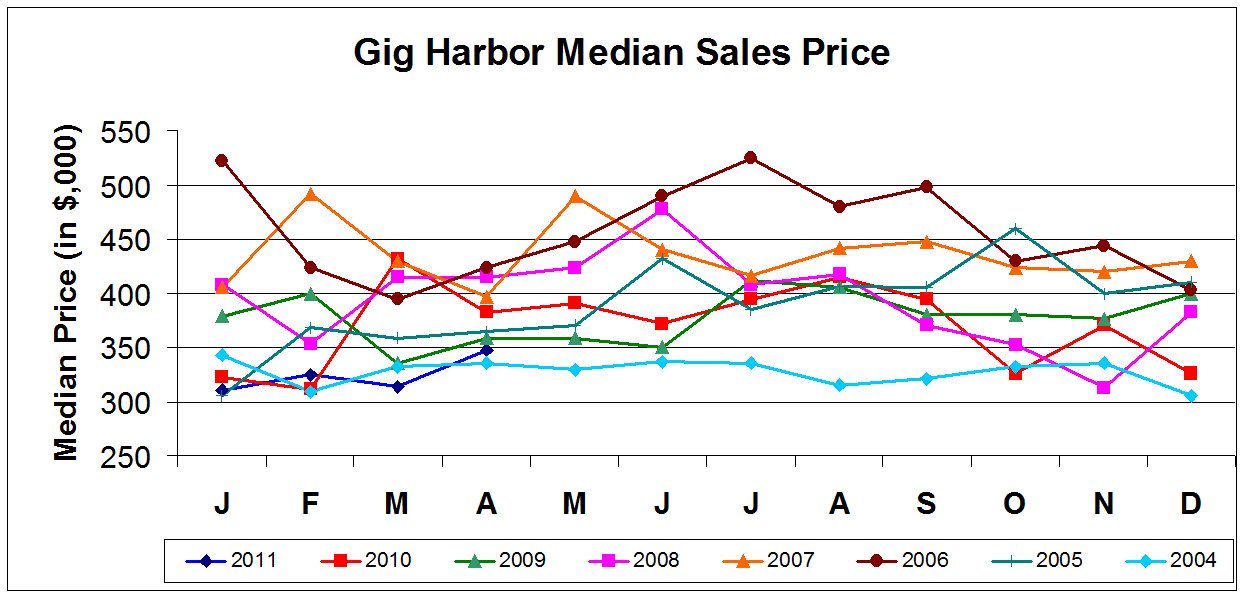

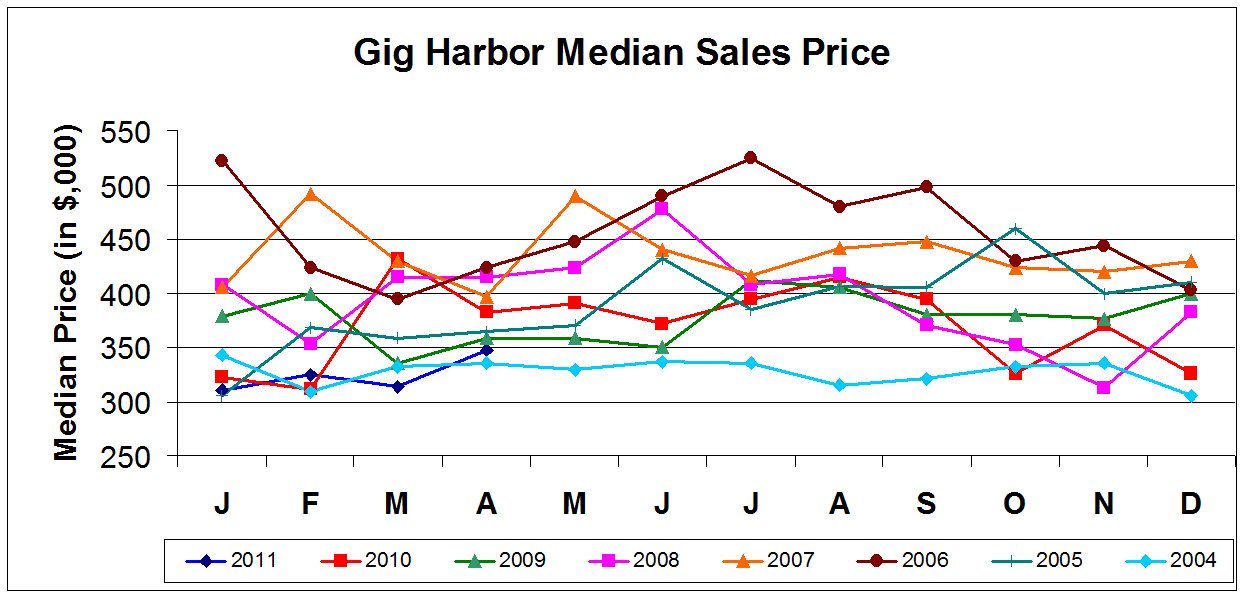

Gig Harbor home prices drop to 2004 levels for the first four months of this year. Prices have clearly not stablized. The 15.4% drop from the same time last year is typical of Pierce county as a whole.

The Gig Harbor peninsula and Fox Island make up the data for Gig Harbor home prices.

April showed improvement, posting the highest median sales figure since November. And the lower inventory is pulling down the supply of homes.

Distressed home sales–mostly bank-owned–represent roughly a third or more of all sales currently. This is applying downward pressure on Gig Harbor home prices. this figure is slightly higher than nationally reported data.

Zillow reported last week that house prices are falling at their fastest rate in over three years. Zillow predicts the market will not bottom nationally until 2012…something no Gig Harbor real estate professional will agrue with.

For buyers–it is great time to buy–mortgages are cheap and bank-owned deals are plentiful.

Carole Holmaas is a Broker at Windermere Real Estate, licensed since 1967.

May

09

2011

Gig Harbor home prices have clearly not yet stabilized as April data shows prices down 15.4% for the last three-month period from a year ago…but up from March. This $348,000 figure is the highest since November and uses the median sales price (half the sales above and half below).

Overall, Gig Harbor home prices are down 5.7% in the last one year compared to the one year period prior. The Gig Harbor peninsula and Fox Island are included in data for Gig Harbor home prices.

Sales volume is right in line with last April and year-to-date figures—and the best since 2007.

Inventory is down nearly 20% from a year ago with an 11 months supply of homes on the market. This drop of listings correlates closely with the rest of the Puget Sound. Buyers in select price ranges may want to monitor that closely as a few areas have become seller’s markets. The $200-250,000 range has only a four month supply and a couple mid to high-end ranges are in a balanced market condition.

Seattle Realtors are reporting they believe the bottom has been reached in that area’s homes priced under $350,000 and with a slimmer supply of good listings some upward pressure is being applied to home prices there. Gig Harbor home prices typically follow suit.

But sales above $800,000 have retrenched deeply in the past couple months as the economy has stumbled with only one closing in April—for $2.1m—a deal that started as early as January.

Distressed home sales—mostly bank-owned– represented a slightly smaller part of April’s closings—36% compared to 42% in March. It is easy to see the downward pressure on Gig Harbor home prices with only 6% of listed homes bank-owned but 31% of all sales bank-owned properties.

Currently the national figure is about 30% of sales. Gig Harbor’s figures have continued to creep up over the past year. According to the Case-Shiller Index, the Seattle/Bellevue/Everett area has about a 12.9 month supply of distressed homes to purge. This represents the “shadow inventory” of homes in varying stages of delinquency and foreclosure as well as listed homes.

Carole Holmaas is a Managing Broker at Windermere Real Estate specializing in waterfront and view properties. She has been licensed since 1967. She maybe reached at 253.549.6611 or Carole@ISellGigHarbor.com.