Feb 28 2016

Gig Harbor waterfront best sales months are here—sellers should be on the market now!

Gig Harbor waterfront best sales months are here—sellers should be on the market now! My graph is a big part of this week’s blog. By choice, buyers of low and medium-low bank Gig Harbor waterfront buy in early spring for the ability to enjoy it starting in May or June. We are approaching March—traditionally one of the most active months for sales. Relocation, purchases of “tear-down homes” for rebuilding, and purchases where the primary interest is view, rather than accessibility, provide additional sales throughout the year. Sales made in March for Gig Harbor waterfront will likely close in April or May—45-60 days out.

BEST SALES MONTHS: March has been the #1 selling month in 4 of the last 18 years for Gig Harbor waterfront . March has actually ranked either #1, #2, or #3 40% of that period. Last year March was #2 in new sales. Aggregated over the years, the best months are July, September, May, June and August in that order. Those sales typically close 45 days later. But those months’ sales include more second home usage, Key Peninsula and generally under $1m price tag.

2015 Waterfront roundup

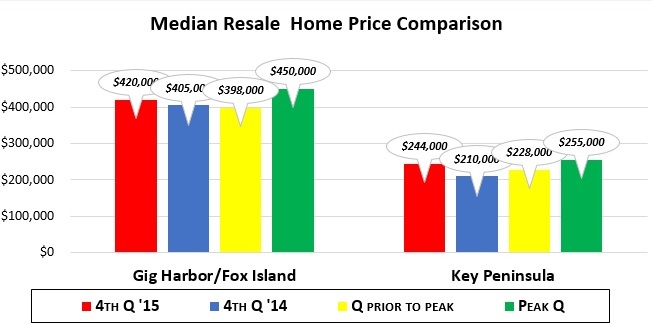

MEDIAN SALES PRICE: 2006-08 were boom years for Gig Harbor waterfront prices—$800-900,000 was the median. But the year just prior to the boom—2005—the median price was where it has been the past 2 years–$600,000.

TOP TIER: The over $1M category produced 1 of every 4 sales in 2015. At the market height 35% of sales were over $1M. That plummeted to 10%—then jumped to 24% last year. 2 of every 3 sales in the top tier were initiated before June, with half by March. Gig Harbor waterfront buyers want to be using the waterfront—either on land or by boat–in the summertime.

INVENTORY: With Gig Harbor waterfront inventory even tighter this year, new listings, if priced right, disappear as fast as they are listed. That should keep prices rising in 2016. The median price of the 37 homes listed in Gig Harbor/Fox Island is $1,100,000 & in Key Peninsula $745,000 for 8 homes. That 45-house total is down from the past couple years. If, on the other hand, many of the 175 waterfront “pent-up sellers” enter the market, it could hold down prices. 175 is my take of the number of Gig Harbor waterfront sellers who would sell and move—if market conditions & prices permit.

I believe the earliest sellers of Gig Harbor waterfront to the marketplace this year will get the benefit of low inventory, coupled with historic low interest.