Jan

26

2014

Gig Harbor home sales

Gig Harbor home sales annual review—strictly resale. This may surprise you but 2nd quarter 2013 and 3rd quarter 2012 realized median sales prices near the 2006 peak of $425,000. This is “strictly resale” homes—not bank-owned nor short-sales.

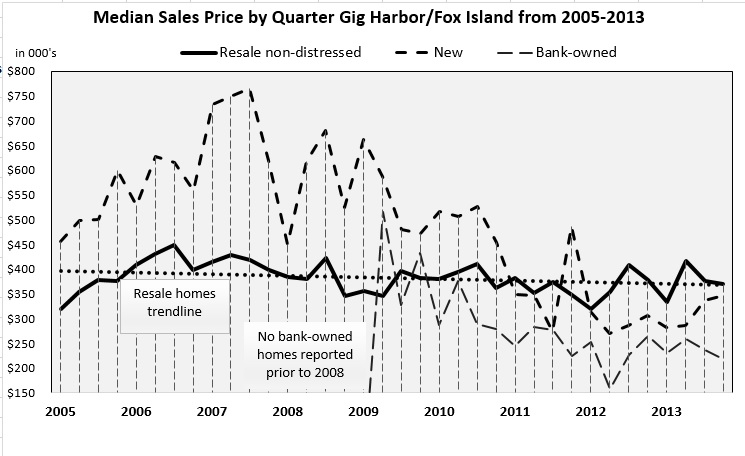

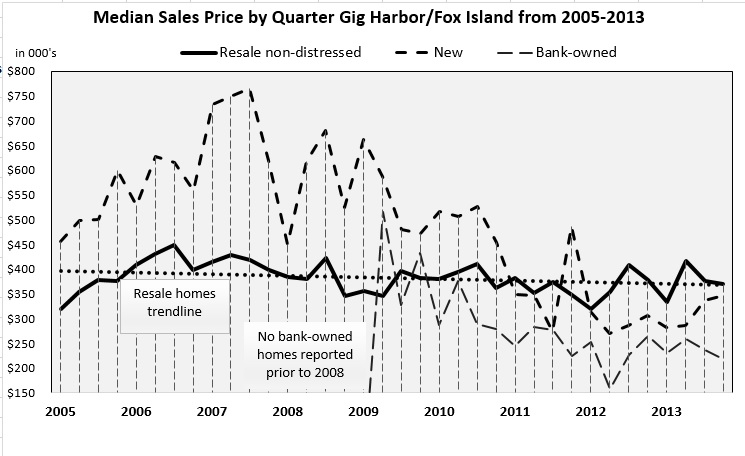

Today’s graph of Gig Harbor home sales shows resale, new and bank-owned sales plus the resale trendline, by quarter, from $400,000 in 2005 to $370,000 today. Resale is now off just 13% from its peak and only 7.5% from its trendline. Sale prices performed well in the first half 2013…but removed much of those gains in the second half…performing at 2005 prices.This is true of all Gig Harbor home sales.

More stats on the resale market

- Current $370,000 sales price is considered neutral, based on a 6-quarter trend

- Sold-to-listing price ratio is up to 94% from 89% a year ago

- With 40-55% of 2006-07 sales new large homes, this pulled up the sales price overall above $450,000 — just as bank-owned sales pulled it down below $325,000

I offer some observations…positive and negative for Gig Harbor home sales

- The recent Boeing contract and high tech industry will produce a more robust housing market than much of the rest of the nation

- Interest rates will likely climb to 5.4% by year’s end and lending will be less supportive to a housing recovery

- Income growth will continue very slowly. This is the deepest and longest employment “recovery” we have experienced since the Depression

- Investors have pulled back from buying homes, creating part of the slowdown in sales since summer

- Inventory will stay low until sellers can retrieve more of their equity—higher sales prices. Nationally 13% of homeowners owe more than their home is worth. Washington is 11th for foreclosure filings, bucking the national trend

- Puget Sound sales volume has dropped the last 3 months after all 2013’s earlier months topped the charts

- January 10’s tighter underwriting standards will keep more first-time buyers renting

Jan

26

2014

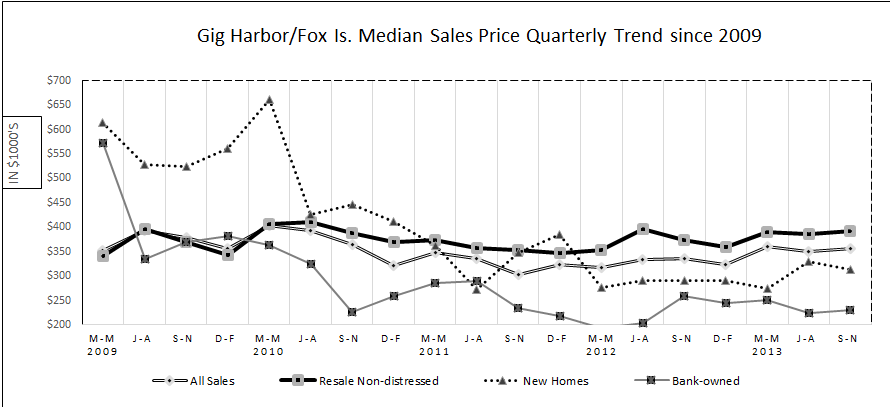

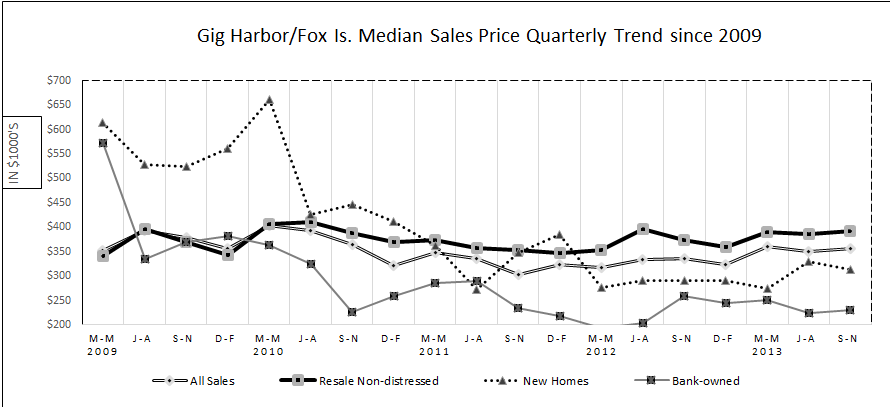

Gig Harbor resale home prices down just 5.1% over peak. Stripping out new home and distressed home sales, Gig Harbor resale prices are actually down just 5.1% from the 2006 peak. Hopefully this week’s graph will provide some perspective for sellers as they contemplate marketing their home in 2014. The numbers show Gig Harbor resale prices down 21% from its boom but that figure includes distressed sales and new home prices that outpaced the rest of the market by $150,000-300,000 at the peak. New homes were much larger than the product being built today in Gig Harbor North. All sales combined are up 6.3% over a year ago.

A caveat – Competition for any home sale depends on the options available to the buyer at that time. It is one thing to compete in a market with a 2-year supply of homes and 50% of it distressed compared to a 4-month supply of homes with only 10% distressed currently.

While first quarter 2013 was the low point for combined Gig Harbor sales prices, this entire year has been the highest (with an exception in early 2010) since first half 2008 for Gig Harbor resale prices itself.

Inventory is down 47% from first half 2008 high. Gig Harbor hasn’t experienced low inventory since 2004-05. This is why brokers routinely urge sellers to consider marketing early in the year – traditionally a low inventory period, producing faster sales and higher prices.

Gig Harbor resale prices

Jan

26

2014

Gig Harbor home prices and sales pause in October

Pending sales volume during October was level with 2012 sales as well as September’s. The higher tiers have seen fewer contracts and closed sales in the past two months.

The consensus is the federal shutdown during the first two weeks of October, the unknown of the Affordable Health Care law and below-normal inventory has shaken consumer confidence.

Consumer confidence “deteriorated considerably” in October as a result of the shutdown and debt ceiling squabbles, according to The Conference Board. A recent Gallup poll found some improvement in Americans’ economic confidence, but reported it is still well below mid-September, before the shutdown

MLS figures summarizing October’s activity show year-over-year drop in inventory (down 10% in Gig Harbor and 20% in Key Peninsula), nearly 20% increase in the volume of closed sales, and healthy increases in selling prices (up 9.4% in Gig Harbor and 5.9% in Key Peninsula).

Gig Harbor’s median price of $350,000 is 9.4% higher than a year ago – 12.9% lower than September – essentially the same as first half 2005 prices. First half November Gig Harbor home prices are also lower.

- As of Nov 17, $285,000 is the median Gig Harbor home price for closed sales

- Gig Harbor home prices are running at 1st half 2005 prices

- Key Peninsula’s median price of $216,000 is 5.9% higher than last year & the same as September

- As of Nov 17, $183,000 is the median for closed sales this month

- Prices are running at 2nd half 2005 prices

- Nationally house prices are expected to increase 4.3% in 2014 and settle around 3.4% after that

- October homes closed at 99% of then current list price. November is seeing a slight tick down from that and slightly longer market time

- Inventory is down 10% for Gig harbor and nearly 20% for Key Peninsula