Jun 28 2017

Gig Harbor high-tier waterfront sales make comeback…and other real estate news

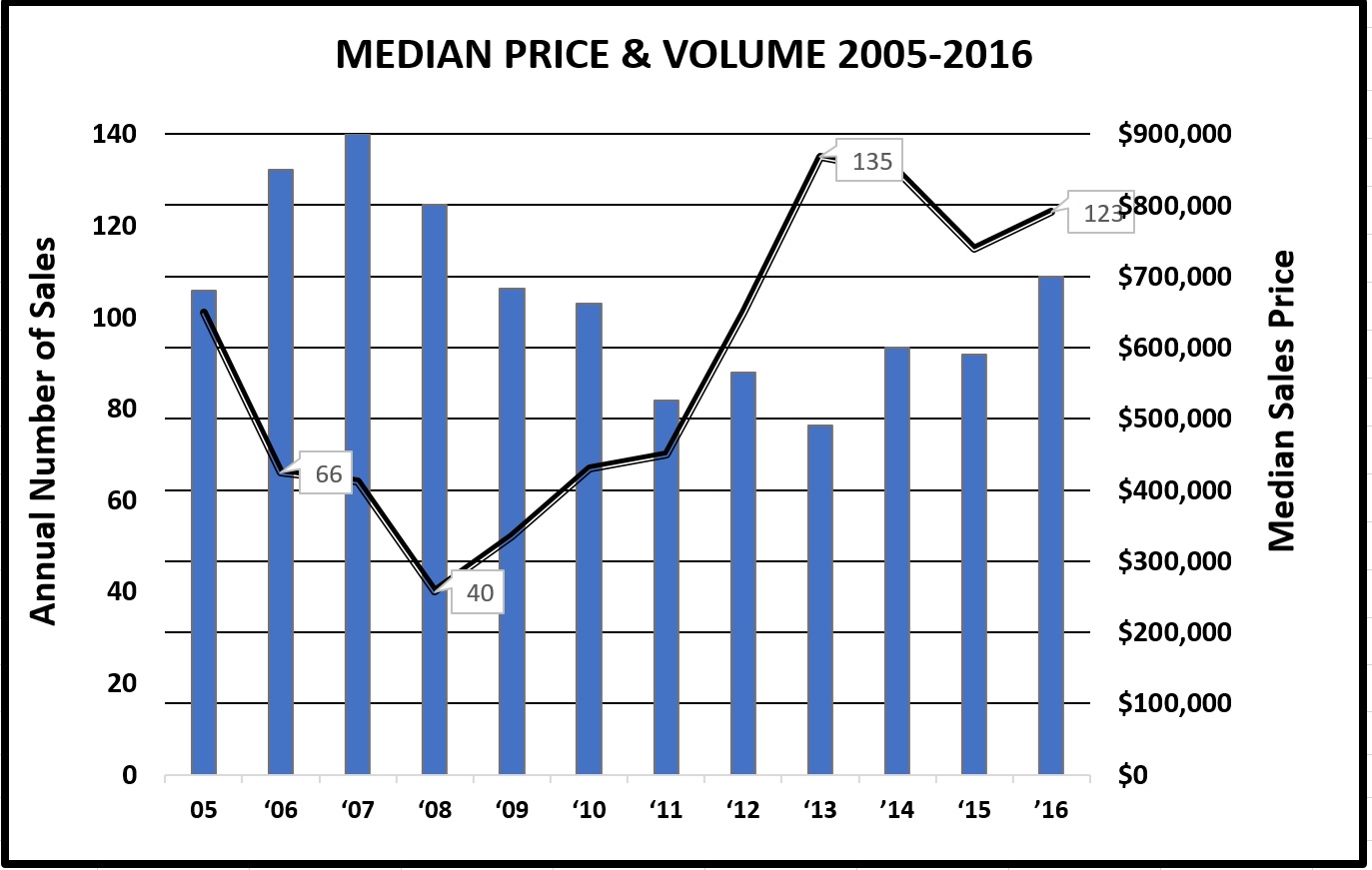

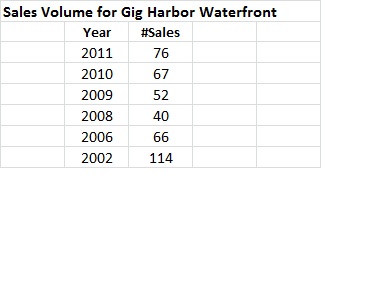

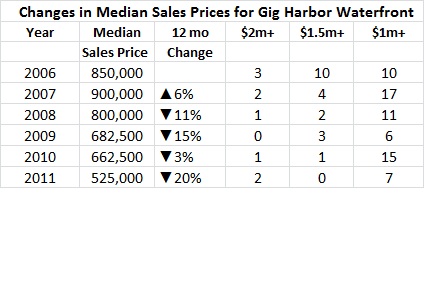

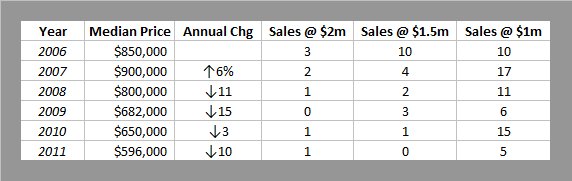

Gig Harbor waterfront high-tier sales make comeback…and other real estate news. Approaching the mid-year point, when typically, one-half of Gig Harbor waterfront sales have closed, the market is on track to end the year with similar volume as last year—115-125 sales. The very high-tier–$2M plus– has already surpassed the last 2 years in numbers. With 3 closed and 2 pending, that’s a 250% increase, in just the first half of the year. It is likely we’ll see a $3M plus Gig Harbor waterfront home sell this year as well.

The $1-1.25M category already has twice as many sales as the whole of 2016.

The conundrum though is between $1.25-$2M. The 2 closed sales to-date compare with 13 for the 2016 year and Gig Harbor waterfront homes currently under contract support the lack of interest, at this time, for this price range. It may be that many of the sellers with pent-up desire to change homes managed to sell their homes last year. And it may be that this season’s inventory is too aggressively priced.

For the first time I can remember, 40% of the homes on the market over $2M are in Gig Harbor Bay, with docks. These Gig Harbor waterfront homes were built within a five-year period a decade plus ago and likely represent the desire for a lifestyle change.

Gig Harbor/Fox Is overall real estate market….

- Highest single month MSP–$525,000

- Most new resale listings for years—up 6.8%

- 2-month supply of homes for sale

- New homes are 35% of sales volume

Key Peninsula

- Just 1.3-month supply

- MSP up 18% for the quarter

- Pending sales up 53% over 2016