Jan 26 2014

Gig Harbor home sales annual review—strictly resale

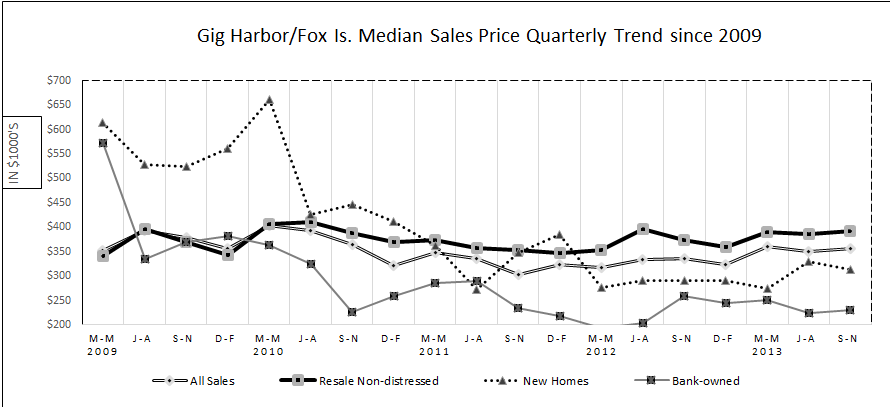

Gig Harbor home sales annual review—strictly resale. This may surprise you but 2nd quarter 2013 and 3rd quarter 2012 realized median sales prices near the 2006 peak of $425,000. This is “strictly resale” homes—not bank-owned nor short-sales.

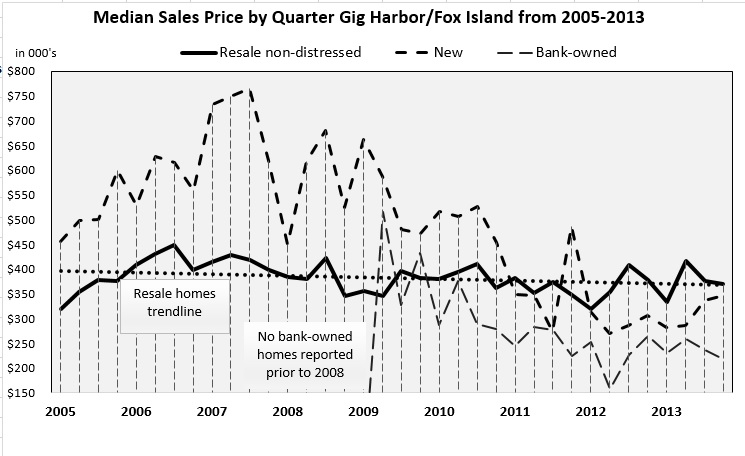

Today’s graph of Gig Harbor home sales shows resale, new and bank-owned sales plus the resale trendline, by quarter, from $400,000 in 2005 to $370,000 today. Resale is now off just 13% from its peak and only 7.5% from its trendline. Sale prices performed well in the first half 2013…but removed much of those gains in the second half…performing at 2005 prices.This is true of all Gig Harbor home sales.

More stats on the resale market

- Current $370,000 sales price is considered neutral, based on a 6-quarter trend

- Sold-to-listing price ratio is up to 94% from 89% a year ago

- With 40-55% of 2006-07 sales new large homes, this pulled up the sales price overall above $450,000 — just as bank-owned sales pulled it down below $325,000

I offer some observations…positive and negative for Gig Harbor home sales

- The recent Boeing contract and high tech industry will produce a more robust housing market than much of the rest of the nation

- Interest rates will likely climb to 5.4% by year’s end and lending will be less supportive to a housing recovery

- Income growth will continue very slowly. This is the deepest and longest employment “recovery” we have experienced since the Depression

- Investors have pulled back from buying homes, creating part of the slowdown in sales since summer

- Inventory will stay low until sellers can retrieve more of their equity—higher sales prices. Nationally 13% of homeowners owe more than their home is worth. Washington is 11th for foreclosure filings, bucking the national trend

- Puget Sound sales volume has dropped the last 3 months after all 2013’s earlier months topped the charts

- January 10’s tighter underwriting standards will keep more first-time buyers renting

Tags: Gig Harbor home sales, home sales gig harbor