Dec 21 2014

Gig Harbor home sales continue nicely in “recovery mode”

Gig Harbor home sales continue nicely in “recovery mode”

In a nutshell—Gig Harbor home sales prices are up, inventory & sales volume are flat, upper tier is appreciating, & new construction is impacting buyers. Here’s my take for the September-November quarter for Gig Harbor & Fox Island, compared to a year ago…

Sales prices ↑ 6.2%

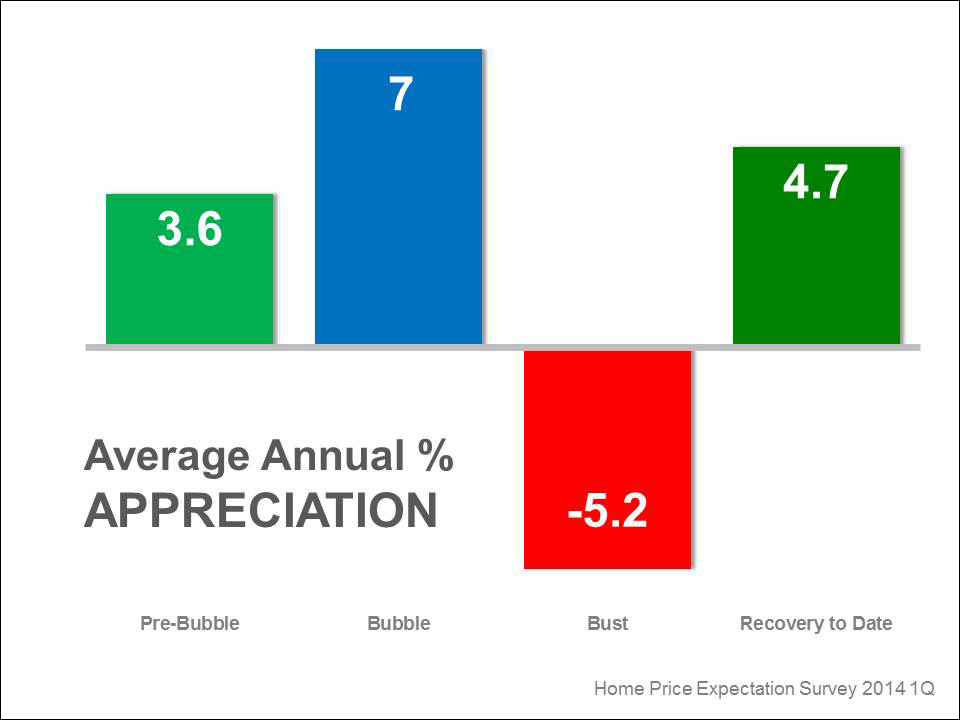

A 6.2% increase in Gig Harbor home sales brings the median sales price (the mid-way point in sales prices) to $378,000 for the quarter. The single month of November was $432,000 — 31% over October and 44% from last November. Prices for Gig Harbor home sales have been gradually strengthening all year after a low of $303,000 in January. This increase should allow more sellers to list – gaining some of the equity lost during the housing bust – and adding to the inventory the market badly needs.

Prices are down 20% from the 2006 third-quarter peak — at summer 2005 prices. Important to note, at the peak, new homes made up a substantial number of sales at $600-750,000, elevating over-all prices. The 6.2% uptick is realistic appreciation I believe, after a stagnant 3 ½ years, ending with second quarter 2014.

Resale non-distressed homes appreciating

These are sales of existing homes – not short sales or bank-owned. Sales prices have steadily been gaining since March, except for October – at $384,000 — down 14% from the 2006 third-quarter peak. The single month of November was $448,000 –the highest single month’s sales price since August 2006 ($475,000) when prices for Gig Harbor home sales turned the corner. However, too much cannot be read into this single month. 22% –11 of the sales were waterfront homes over the median sales price – never before seen in November.

Sales Volume ↑ 1.4%

Pendings ↑15.9%

Contracts written but not yet closed are up with renewed consumer confidence, threat of future higher interest rates and easing of loan requirements.

Inventory “flat”

Inventory is still low, which can lead to multiple offers and homes selling above their list prices. Routine in the Seattle area but it happens here too. Local brokers point to the quality of some homes plus unrealistic pricing in Gig Harbor. They say buyers often will not even look at a house they perceive to be over-market but wait for a price reduction before even viewing it.

New home inventory 26% of the market

With a quarter of all inventory new homes the market is decidedly different for buyers than a year ago when it made up only 16%. With fewer resale homes – and more new homes –some buyers are having to change search parameters – especially when it comes to lot size. The Growth Management Act regulates density where utilities can service it, forcing smaller lots. Half of new homes currently are on smaller square footage than the traditional 12,500 – 35% are on 5000 or less –and half of those on less than 2300. This can provide more buyer interest for resale homes on larger sites.

Short-sales ↓50% – REO’s flat

The distressed market continues to retreat — just 10% of Gig Harbor home sales. It was 13% last year.

Waterfront sales on par with 2013

Sales volume on the two peninsulas looks to nearly equal the 135 sales last year. But the real story here is increasing prices – we could see a median sales price uptick of $100,000 when all the dust settles—bringing it to the $600,000 range. And even bigger news is the $1m plus tier for Gig Harbor home sales . 2014 will end with the same number of sales over $1m as in 2006 and 2007—21. Over 90% of the $1m sales came in the last half of the year – again low interest, good values, and increased consumer confidence. (See Resale Non-Distressed Sales above)

Tags: Gig Harbor home sales, home sales gig harbor